Market For Loanable Funds Diagram

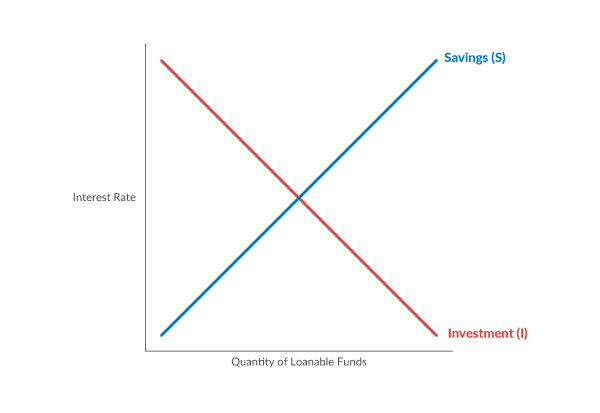

Market For Loanable Funds Diagram. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. But 14 percent is not what they will receive. In this one i draw and explain the graph for loanable funds and crowding out. The crowding out effect occurs when a government runs a budget deficit (it spends more. Module 29 the market for loanable funds krugman's macroeconomics for ap* margaret ray and david anderson what you will learn in this module: The market for loanable funds. • the loanable funds market is the market where those who have excess funds can supply it to • combining the previous diagram to what we have learnt so far in macroeconomics, we can see that in this market, we have the demand and the supply of loanable funds. Market for loanable funds is the interaction of borrowers and lenders that determines the market interest rate and the quantity of loanable funds exchanged. The term loanable funds is used to describe funds that are available for borrowing.

5 questions with explanations to help you quickly review how to draw and manipulate the loanable funds market graph. The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the quantity of loanable funds exchanged. What is meant by the term crowding out? Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance expenditures (investment or consumption). The crowding out effect occurs when a government runs a budget deficit (it spends more.

In this one i draw and explain the graph for loanable funds and crowding out.

In this lesson on loanable funds market, you will learn the following: For the market of loanable funds, the supply curve is determined by the aggregate level of savings within the economy. • the loanable funds market is the market where those who have excess funds can supply it to • combining the previous diagram to what we have learnt so far in macroeconomics, we can see that in this market, we have the demand and the supply of loanable funds. The market for loanable funds is a market where those who have loanable funds sell to those who want loanable funds. Also, everyone looking for a loan (either to spend it or to invest it) comes to the supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his. Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance expenditures (investment or consumption). The loanable funds market graph background. • how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how. Using the accompanying diagram, explain what will happen to the market for loanable funds when there is a fall of 2 percentage points in the expected future. The market for loanable funds consists of two actors, those loaning the money (savings from households like us). In the market for loanable funds! The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance expenditures (investment or consumption). The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the quantity of loanable funds exchanged. Also, everyone looking for a loan (either to spend it or to invest it) comes to the supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his. What entities demand money from the loanable funds market? Perhaps the most common shift of the loanable funds market is the crowding out effect. • how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how. Savings in excess of supply of loanable funds could be stored away as. For ap, ib, and college macroeconomics principles. Ski market knows that the most people will pay for the snowboards is $129.99. A hypothetical market that brings together those who want to lend money and those who want to borrow money.

In economics, the loanable funds doctrine is a theory of the market interest rate.

How do savers and borrowers find each other? Demand for loanable funds• the demand curve for loanable funds slopes downward, because the decision for a business to borrow money to finance a project depends on the interest rate the business faces and the rate of return on its project (which is the profit earned on the project. In this video, learn how the demand of loanable funds and the supply of loanable funds interact to determine real interest rates. Suppliers of loanable funds would prefer 14 per cent to any other interest rate in the table. D is downward sloping because at the higher rate of interest means higher the (opportunity) cost to firms to finance investment. The crowding out effect occurs when a government runs a budget deficit (it spends more. The term loanable funds is used to describe funds that are available for borrowing. Plfs intermediate markets for loanable funds, with suppliers of funds earning interest. But 14 percent is not what they will receive. • how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. All lenders and borrowers of loanable funds are participants in the loanable.

• the loanable funds market is the market where those who have excess funds can supply it to • combining the previous diagram to what we have learnt so far in macroeconomics, we can see that in this market, we have the demand and the supply of loanable funds. The market for loanable funds consists of two actors, those loaning the money (savings from households like us). What entities demand money from the loanable funds market? 5 questions with explanations to help you quickly review how to draw and manipulate the loanable funds market graph.

• how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how.

Demand for loanable funds• the demand curve for loanable funds slopes downward, because the decision for a business to borrow money to finance a project depends on the interest rate the business faces and the rate of return on its project (which is the profit earned on the project. To watch the loanable funds practice video please go to the ultimate. All lenders and borrowers of loanable funds are participants in the loanable. Suppose japan attracts an increased amount of investment from the european union. D is downward sloping because at the higher rate of interest means higher the (opportunity) cost to firms to finance investment. Using the accompanying diagram, explain what will happen to the market for loanable funds when there is a fall of 2 percentage points in the expected future. The market for loanable funds consists of two actors, those loaning the money (savings from households like us). But 14 percent is not what they will receive. Using a correctly labeled graph of the loanable funds market. When a firm decides to expand its capital stock, it can finance its purchase of capital in several ways. Loanable funds consist of household savings and/or bank loans. What is meant by the term crowding out? What happens in the loanable funds market when the government runs deficit? The loanable funds market therefore recognizes the relationships.

D is downward sloping because at the higher rate of interest means higher the (opportunity) cost to firms to finance investment loanable funds diagram. It slopes downwards because when the interest rate decreases, it becomes cheaper to borrow money.

Source: d1yqpar94jqbqm.cloudfront.net

Source: d1yqpar94jqbqm.cloudfront.net What is meant by the term crowding out?

Source: myincandescentmind.files.wordpress.com

Source: myincandescentmind.files.wordpress.com The loanable funds theory uses the schedules of supply and demand for loanable funds while the classical theory used only the supply and demand as these forces operate in the loanable funds market, it is their net effect which goes to determine the market rate of interest.

Source: images.slideplayer.com

Source: images.slideplayer.com Also, everyone looking for a loan (either to spend it or to invest it) comes to the supply for loanable funds (slf) curve slopes upward because the higher the real interest rate, the higher the return someone gets from loaning his.

Source: econ101help.com

Source: econ101help.com All lenders and borrowers of loanable funds are participants in the loanable.

In economics, the loanable funds doctrine is a theory of the market interest rate.

Source: study.com

Source: study.com All lenders and borrowers of loanable funds are participants in the loanable.

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net But 14 percent is not what they will receive.

For ap, ib, and college macroeconomics principles.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net The loanable funds market therefore recognizes the relationships.

Source: d2vlcm61l7u1fs.cloudfront.net

Source: d2vlcm61l7u1fs.cloudfront.net Module 29 the market for loanable funds krugman's macroeconomics for ap* margaret ray and david anderson what you will learn in this module:

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net Savings and investment are affected primarily by the interest rate.

Source: ifioque.com

Source: ifioque.com In economics, the loanable funds doctrine is a theory of the market interest rate.

What is meant by the term crowding out?

Source: i.ytimg.com

Source: i.ytimg.com What happens in the loanable funds market when the government runs deficit?

To watch the loanable funds practice video please go to the ultimate.

Source: thismatter.com

Source: thismatter.com • how the loanable funds market matches savers and investors • the determinants of supply and demand in the loanable funds market • how.

Source: upload.wikimedia.org

Source: upload.wikimedia.org The term loanable funds is used to describe funds that are available for borrowing.

Source: i.ytimg.com

Source: i.ytimg.com For the market of loanable funds, the supply curve is determined by the aggregate level of savings within the economy.

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com Businesses it makes the purchases of capital goods.

Source: welkerswikinomics.com

Source: welkerswikinomics.com Module 29 the market for loanable funds krugman's macroeconomics for ap* margaret ray and david anderson what you will learn in this module:

Source: image1.slideserve.com

Source: image1.slideserve.com But 14 percent is not what they will receive.

Source: i1.wp.com

Source: i1.wp.com But 14 percent is not what they will receive.

Source: images.slideplayer.com

Source: images.slideplayer.com The market for loanable funds shows the interaction between borrowers and lenders that helps determine the market interest rate and the quantity of loanable funds exchanged.

Source: apbabbitt.files.wordpress.com

Source: apbabbitt.files.wordpress.com The market for loanable funds consists of two actors, those loaning the money (savings from households like us).

Source: welkerswikinomics.com

Source: welkerswikinomics.com Ski market knows that the most people will pay for the snowboards is $129.99.

Source: img.17qq.com

Source: img.17qq.com The loanable funds market therefore recognizes the relationships.

Source: www.mrmedico.info

Source: www.mrmedico.info According to this approach, the interest rate is determined by the demand for and supply of loanable funds.

Source: s3.studylib.net

Source: s3.studylib.net But 14 percent is not what they will receive.

Source: study.com

Source: study.com • and they also determine the.

In reality, however, current level of saving is not the quantity of loanable funds supplied.

Source: welkerswikinomics.com

Source: welkerswikinomics.com Perhaps the most common shift of the loanable funds market is the crowding out effect.

Posting Komentar untuk "Market For Loanable Funds Diagram"