Loanable Funds Market Demand Curve

Loanable Funds Market Demand Curve. The demand for loanable funds shifts to the right, and interest rates rise. With demand for capital constant, interest. Bond prices have negative relation with interest rates. The demand and supply for different types of capital take place in capital markets. In the market for loanable funds, suppose the current interest rate is 5%. This causes the supply of loanable funds (savings curve). • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities. In the market for loanable funds! The demand for loanable funds shifts to the right, and interest rates rise. Anything that increases the amount of investment that households and. Stock exchanges, investment banks, mutual funds firms, and commercial banks.

The supply of loanable funds curve the supply of loanable funds is the relationship between the quantity of loanable funds supplied and the real interest rate when all other influences on lending. With demand for capital constant, interest. According to this approach, the interest rate is determined by the demand for and supply of loanable funds. • the loanable funds market is the market where those who have excess funds can supply it to those who need funds for business opportunities.

Quantity of money, we see that we have a basic supply and demand graph.

The demand and supply for different types of capital take place in capital markets. In these capital markets, firms are typically demanders of capital, while households are typically suppliers of capital. The equilibrium interest rate is determined by the intersection of the demand and supply curves in the market for loanable funds. The demand for loanable funds shifts to the right, and interest rates rise. Anything that increases the amount of investment that households and. Lending is demonstrated by a demand curve while borrowing is demonstrated by supply curve. In the market for loanable funds! Stock exchanges, investment banks, mutual funds firms, and commercial banks. • the loanable funds market includes: The loanable funds market is in equilibrium. The aggregate loanable fund supply curve sl also slopes upwards to the right showing the greater supply of loanable funds are also demanded for hoarding purposes that is for the satisfaction of the desire of market rate of interest is that which equates the supply of and demand for loanable funds. The demand for loanable funds is the relationship between the quantity of loanable funds demanded and the real interest rate when all other influences on borrowing plans remain the same. The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits. The demand for loanable funds is determined by the amount that consumers and firms desire to invest.

Savings and investment are affected primarily by the interest rate. It is true that both supply and demand gets fluctuate in the loanable fund market. The loanable funds market is in equilibrium. Demand for loanable funds• the demand curve for loanable funds slopes downward, because the decision for a business to borrow money to finance a project depends on the interest rate the business faces and the rate of return on its project (which is the profit earned on the project. The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity. If cultural shifts cause the market to shun corn in favor of quinoa.

In the loanable funds framework, the supply represents the total amount that is being lent out at different interest rates or the amount being saved in the.

Expected profits and demand for loanable funds move the market for loanable funds. Loanable funds market supply of loanable funds loanable funds come from three places 1. Stock exchanges, investment banks, mutual funds firms, and commercial banks. Curves of supply and curves of demand are responsible in determining the real interest rate. The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan. In the market for loanable funds, suppose the current interest rate is 5%. The aggregate loanable fund supply curve sl also slopes upwards to the right showing the greater supply of loanable funds are also demanded for hoarding purposes that is for the satisfaction of the desire of market rate of interest is that which equates the supply of and demand for loanable funds. In the loanable funds framework, the supply represents the total amount that is being lent out at different interest rates or the amount being saved in the. Anything that increases the amount of investment that households and. The demand curve for loanable funds is downward sloping, indicating that at lower interest rates. The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity. This causes the supply of loanable funds (savings curve). Firms will have a choice of a range of projects ranging from the most profitable to the least profitable.

This causes the supply of loanable funds (savings curve). People who are interested in borrowing money are more. When displayed on a graph of real interest rate vs. The equilibrium interest rate is determined by the intersection of the demand and supply curves in the market for loanable funds. Loanable funds market supply of loanable funds loanable funds come from three places 1.

The term loanable funds includes all forms of credit, such as loans, bonds, or savings deposits.

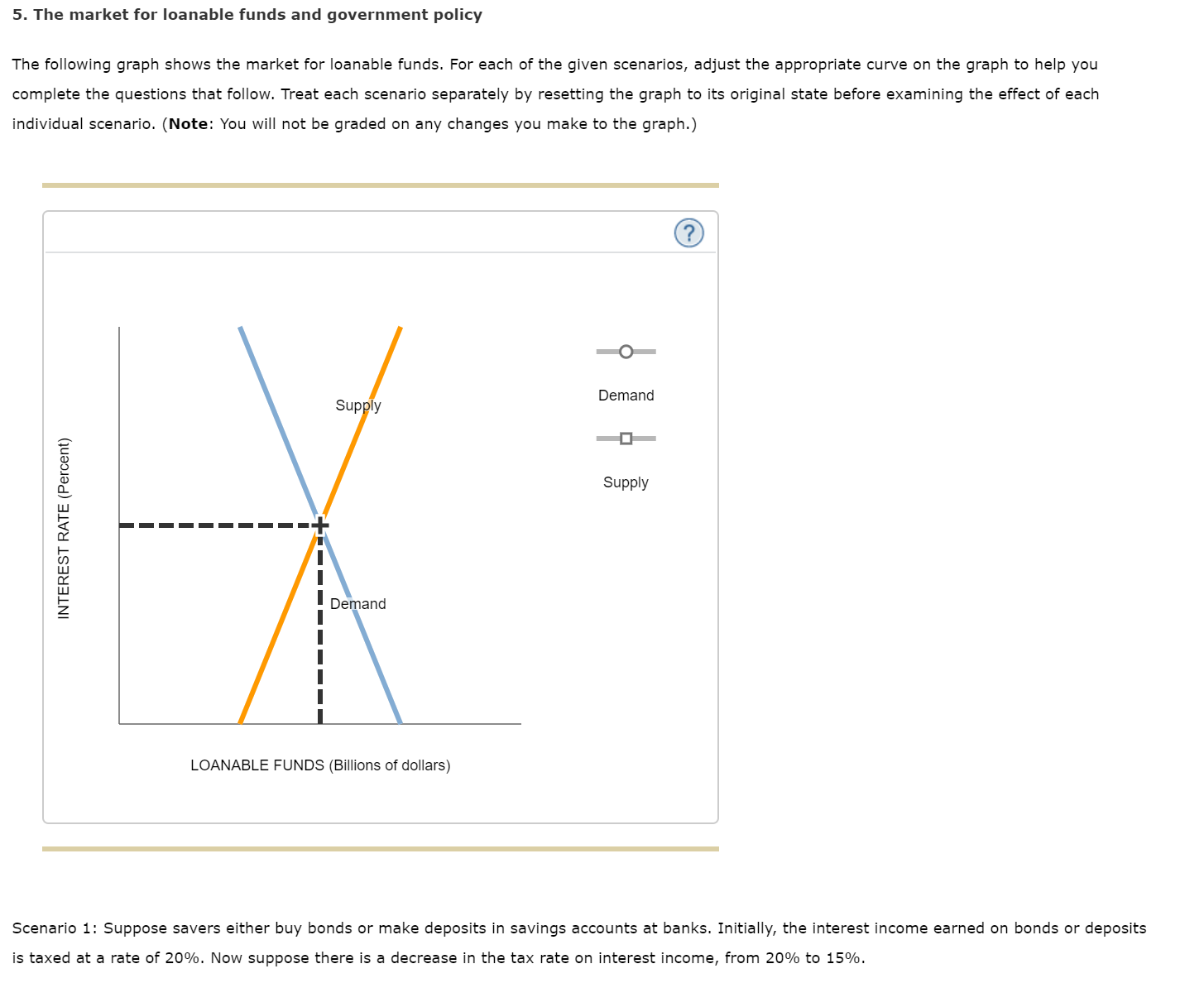

When the supply of loanable funds increases the supply curve of loanable funds curve shifts rightward. • the loanable funds market includes: The market for loanable funds is where borrowers and lenders get together. So drawing, manipulating, and analyzing the loanable funds market isn't too difficult if you remember a few key things. The loanable funds market graph background. Due to a change in tax law, many workers increase what happens? Lending is demonstrated by a demand curve while borrowing is demonstrated by supply curve. In these capital markets, firms are typically demanders of capital, while households are typically suppliers of capital. In the market for loanable funds! Savings and investment are affected primarily by the interest rate.

The loanable funds market is like any other market with a supply curve and demand curve along with an equilibrium price and quantity loanable funds curve. If the supply curve shifts to the left, what will happen in the long run?

Source: apbabbitt.files.wordpress.com

Source: apbabbitt.files.wordpress.com So, the interest rate fall and rises.

Quantity of money, we see that we have a basic supply and demand graph.

Source: i.stack.imgur.com

Source: i.stack.imgur.com The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan.

Source: welkerswikinomics.com

Source: welkerswikinomics.com Match one person's saving with another person's investment.

Source: prod-qna-question-images.s3.amazonaws.com

Source: prod-qna-question-images.s3.amazonaws.com The loanable funds market graph background.

Source: www.cliffsnotes.com

Source: www.cliffsnotes.com See this document from the bank of england.

Source: media.cheggcdn.com

Source: media.cheggcdn.com Firms will have a choice of a range of projects ranging from the most profitable to the least profitable.

The loanable funds market is in equilibrium.

Source: i.stack.imgur.com

Source: i.stack.imgur.com When the supply of loanable funds increases the supply curve of loanable funds curve shifts rightward.

Source: img.homeworklib.com

Source: img.homeworklib.com The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan.

Source: i.stack.imgur.com

Source: i.stack.imgur.com The demand for loanable funds is limited by the marginal efficiency of capital, also known as the marginal efficiency of investment, which is the rate of return that could be earned with additional capital.

Source: www.opentextbooks.org.hk

Source: www.opentextbooks.org.hk Savings and investment are affected primarily by the interest rate.

Source: present5.com

Source: present5.com In the market for loanable funds!

Source: i.ytimg.com

Source: i.ytimg.com The demand for loanable funds is the relationship between the quantity of loanable funds demanded and the real interest rate when all other influences on borrowing plans remain the same.

Source: 3.bp.blogspot.com

Source: 3.bp.blogspot.com Due to a change in tax law, many workers increase what happens?

Source: o.quizlet.com

Source: o.quizlet.com As with other markets, there is a supply curve and a demand curve.

Source: www.ineteconomics.org

Source: www.ineteconomics.org When displayed on a graph of real interest rate vs.

Source: www.economicsdiscussion.net

Source: www.economicsdiscussion.net If cultural shifts cause the market to shun corn in favor of quinoa.

Source: www.personal.psu.edu

Source: www.personal.psu.edu The market for loanable funds is where borrowers and lenders get together.

Source: study.com

Source: study.com If the supply curve shifts to the left, what will happen in the long run?

In the market for loanable funds!

Source: socialsci.libretexts.org

Source: socialsci.libretexts.org Match one person's saving with another person's investment.

Source: s3.studylib.net

Source: s3.studylib.net This causes the supply of loanable funds (savings curve).

The demand for loanable funds shifts to the right, and interest rates rise.

Source: penpoin.com

Source: penpoin.com Expected profits and demand for loanable funds move the market for loanable funds.

Source: www.opentextbooks.org.hk

Source: www.opentextbooks.org.hk Savings and investment are affected primarily by the interest rate.

Source: www.econlowdown.org

Source: www.econlowdown.org The demand for loanable funds (dlf) curve slopes downward because the higher the real interest rate, the higher the price someone has to pay for a loan.

Source: s3.studylib.net

Source: s3.studylib.net Lending is demonstrated by a demand curve while borrowing is demonstrated by supply curve.

Posting Komentar untuk "Loanable Funds Market Demand Curve"